3-5-2025 – Substantial institutional movement has surfaced in the Ethereum markets, with sophisticated players orchestrating significant positions through decentralised finance channels. Notable transactions include a $5.7 million acquisition via Aave lending protocols, whilst a freshly-minted wallet executed a $4.12 million withdrawal from Binance’s coffers.

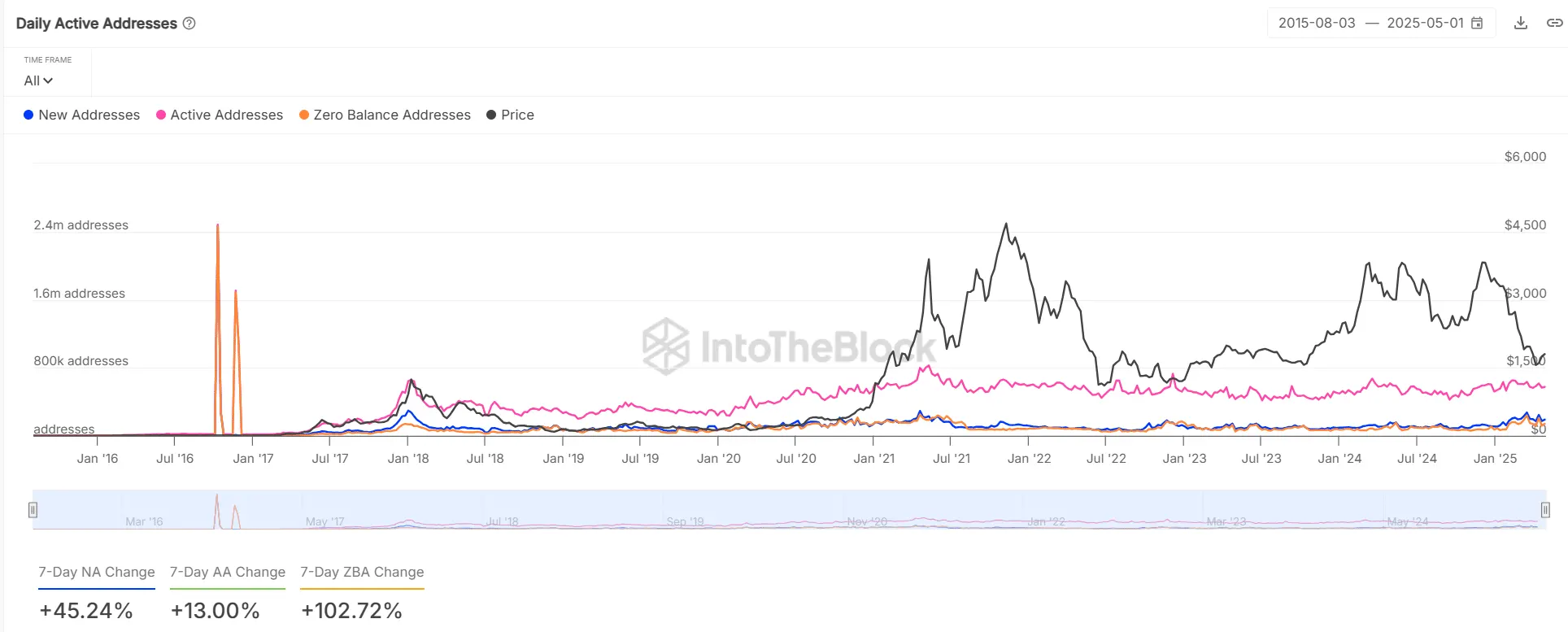

Network participation has witnessed a remarkable uptick, with a 45.24% surge in new wallet creation over the past week. Perhaps more telling is the 102% rise in zero-balance addresses, suggesting a renaissance of dormant capital or strategic repositioning amongst existing stakeholders. Active addresses have similarly climbed by 13%, painting a picture of reinvigorated market engagement.

The technical landscape presents intriguing developments, with ETH breaking free from a descending wedge pattern. This emergence sets the stage for potential advances toward resistance markers at $2,139, with subsequent Fibonacci extensions suggesting possible targets at $2,354 and $2,638. At present, Ethereum changes hands at $1,819.34, marking a modest 0.45% appreciation over the previous day’s trading.

However, the path hasn’t been without its casualties. The second day of May witnessed a substantial clearing of overleveraged positions, predominantly affecting bullish traders. Long liquidations reached $5.29 million, dwarfing the $1.07 million in short positions eliminated. Binance and Bybit bore the brunt of these position unwindings.

Derivatives markets signal renewed speculative appetite, with Open Interest expanding by 4.67% to reach $12.06 billion. This surge in positioning, coupled with sustained institutional accumulation, suggests growing conviction among market participants following a period of consolidation.

The convergence of robust on-chain metrics, sustained whale accumulation, and improving technical structure presents an increasingly constructive outlook. Whilst near-term caution remains prudent following recent liquidation events, the clearing of overleveraged positions often precedes more sustainable market advances.

Despite current price action remaining subdued below the $1,825 threshold, the comprehensive market structure appears increasingly favourable for Ethereum’s medium-term prospects, provided recent support levels maintain their integrity and capital inflows persist.