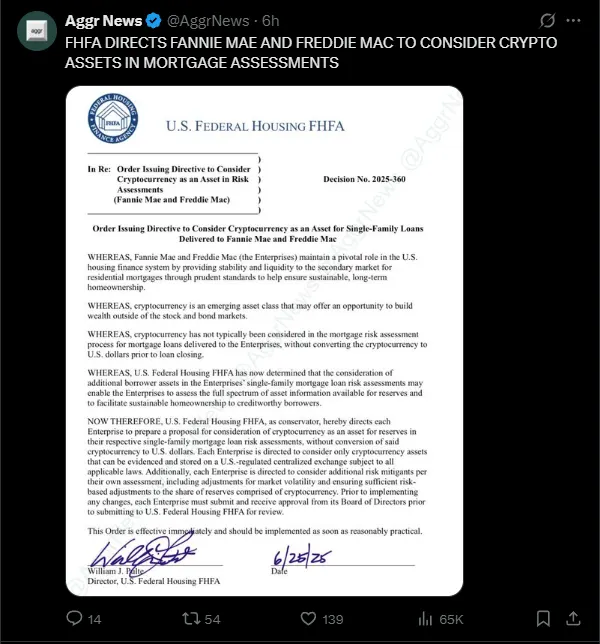

26-6-2025 – The Federal Housing Finance Agency (FHFA), the US regulator tasked with overseeing mortgage giants Fannie Mae and Freddie Mac, has mandated that these institutions explore the inclusion of cryptocurrencies as viable assets in risk assessments for single-family mortgage loans. Announced on 25 June, this directive, issued by FHFA Director William Pulte, could pave the way for prospective homeowners to leverage their digital asset holdings to secure loans, marking a significant shift in the American housing market.

Pulte, aligning with President Donald Trump’s ambition to position the United States as the global epicentre of cryptocurrency innovation, shared the development in a social media post. He revealed that he had instructed Fannie Mae and Freddie Mac—entities that have been under government conservatorship since the 2008 subprime mortgage crisis—to prepare their systems to recognise cryptocurrencies as legitimate assets for mortgage eligibility. This aligns with Trump’s broader vision, which has seen him champion pro-crypto policies, including appointing regulators sympathetic to the industry and engaging directly with its leaders at the White House.

Fannie Mae and Freddie Mac, which collectively back more than half of the nation’s mortgages, now face the challenge of integrating volatile digital currencies into their risk evaluation frameworks. Cryptocurrencies, such as Bitcoin, are notorious for their unpredictable price fluctuations; Bitcoin itself endured a 16 per cent plunge in a single week in February, its steepest decline in two years, though it has since rebounded to record highs. To mitigate these risks, Pulte’s directive stipulates that only digital assets held on US-regulated, centralised exchanges will qualify, and the agencies must devise robust safeguards to address market volatility. These plans will require FHFA approval before implementation.

The directive reflects a broader push by the Trump administration to reshape US cryptocurrency policy, bolstered by the president’s outreach to industry stakeholders during his campaign. By recognising digital assets in mortgage assessments, Pulte argued, Fannie Mae and Freddie Mac could gain a more comprehensive view of a borrower’s financial health, potentially unlocking homeownership opportunities for creditworthy individuals.